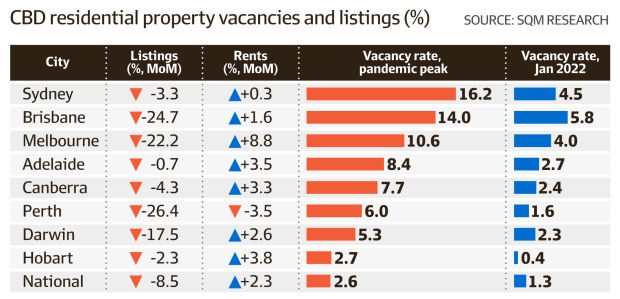

The residential vacancy rate has slumped to a 16-year low of 1.3 per cent nationwide over January as the proportion of empty rental apartments in central business districts fell below their pre-pandemic levels, data from SQM Research shows.

A combination of falling listings and rising demand from tenants moving out of shared houses fuelled a sharp drop in vacancy rates across the CBDs, said Louis Christopher, SQM Research managing director.

The vacancy rate in Sydney’s CBD dropped by 1.2 percentage points from December to 4.5 per cent, lower than the 4.6 per cent recorded before the onset of COVID-19.

In Melbourne, vacancies have fallen by 1.7 percentage points to 4 per cent from the previous month, also below the pre-pandemic level of 4.6 per cent.

At their peaks, Sydney CBD vacancy rates soared to 16.2 per cent and Melbourne hit 10.6 per cent.

“We were expecting a drop in rental vacancies over January due to seasonality. However, the drops were larger than expected,” said Mr Christopher.

“It implies that the rental market conditions are very tight and likely to remain so over the next few months. And now with the international border reopening and a part-return to working from the office continuing, it’s highly likely that CBD and inner-city rental vacancy rates are going to fall further from here.”

Rents rise as listings fall

The proportion of empty rental apartments in the Brisbane CBD has dropped by 1.7 percentage points to 5.8 per cent. It fell by 1.4 percentage points to 2.4 per cent in Canberra and by 0.5 percentage point to 2.7 per cent in Adelaide.

The vacancy rate fell by 0.1 percentage points to 1.6 per cent in Perth, by 0.2 percentage points to 0.4 per cent in Hobart and by 0.6 percentage points to 2.3 per cent in Darwin.

Rental listings have fallen sharply across the capital cities, led by Brisbane, with a 16.8 per cent drop in the four weeks ended February 9.

Total rental listings across Sydney fell by 7.2 per cent during the same period. They slumped by 11.4 per cent in Melbourne, 13.9 per cent in Adelaide and 12 per cent in Canberra and 16.2 per cent in Darwin, but rose by 3.1 per cent in Perth.

“All this represents an acute shortage of rental properties, and it has already been translating into large surges in weekly rents across the country,” said Mr Christopher.

“It is now very likely market rents will rise by over 10 per cent nationally this year, and it could actually be much more as we are recording a rise in capital city combined rents of 5.2 per cent just in the last 90 days. As such there are major ramifications for core and headline inflation.”

Across Sydney, asking rents jumped by 2.6 per cent in the past month and climbed by 2.8 per cent in Melbourne. Asking rents rose by 0.7 per cent in Brisbane and lifted by 1.9 per cent in Adelaide. Nationally, rents rose by 1.5 per cent.

Over the year, rents rose by 8.3 per cent in Sydney, 3 per cent in Melbourne, 11.1 per cent in Brisbane and 10.6 per cent in Perth. Rents rocketed by 12.7 per cent in Adelaide and by more than 9 per cent in Canberra and Hobart. Across the country rents surged by 9.2 per cent.

“It’s a really challenging situation for tenants right now, with rents rising sharply,” said Mr Christopher.

“As long as the rental markets remain tight, then rents will continue to rise.”

Source: AFR